A-17, Upper Ground Floor,

Block-A, Pushpanjali Enclave

Pitampura,

New Delhi,

Delhi

110034

Email id: info@msbetrade.com

Phone No.: 011-47107777

Website : www.msbetrade.com

CIN No. U74899DL1993PLC054541

GST No. 07AAACB2837M1ZL

KYC : 011-47107733

Fax.: 91-011-47107731

info@msbetrade.com,

dp@msbetrade.com

| Trading | 011-47107732, 011-47107734, 011-47107736 |

| DP | 011-47107739 Email id: dp@msbetrade.com |

| KYC | 011-47107733 Email id: kychelp@msbetrade.com |

| Accounts | 011-47107744 Email id: accounts@msbetrade.com |

| Technical | 011-47107722, 011-47107723 Email id: satish@msbetrade.com |

| Exchange-Member Id / DP-DP Id / RP-DP ID | Helpline Number for cyber attacks | Email Id for reporting of cyber attacks |

|---|---|---|

|

NSE-12788/ BSE-6395/ MSEI-21000/ MCX-29905/ NCDEX-00732/ CDSL-DP-12070600/ CCRL-RP-12070600 |

011-47107722 | satish@msbetrade.com |

| Details of | Contact Person | Address | Contact No. | Email Id | |

|---|---|---|---|---|---|

| Customer Care | Mr. Deepak Garg | A-17, Upper Ground Floor, Block-A, Pushpanjali Enclave Pitampura, New Delhi, Delhi 110034 | 011-47107733 | kychelp@msbetrade.com | |

| Head of Customer Care | Mr. Nitin Sharma | 011-47107736 | nitin@msbetrade.com | ||

| Compliance Officer | Mr. Surinder Kumar | 011-47107730 | surin@msbetrade.com | ||

| CEO | Mr. MUNISH BAJAJ | 011-47107729 | md@msbetrade.com | ||

| In absence of response/complaint not addressed to your satisfaction, you may lodge a complaint with SEBI at https://scores.sebi.gov.in/ or Exchanges at https://investorhelpline.nseindia.com/NICEPLUS and https://bsecrs.bseindia.com/ecomplaint/frmInvestorHome.aspx and https://ncdex.com/investor_complaint and https://www.mcxindia.com/Investor-Services and CDSL at https://www.cdslindia.com/Footer/grievances.aspx . Please quote your Service Ticket/Complaint Ref No. while raising your complaint at SEBI SCORES/Exchange portal. | |||||

| Stock Broker Name | Registration Number | Registered Address | Branch Address(if any) | Contact Number | Email Id |

|---|---|---|---|---|---|

| MSB e-Trade Securities Limited |

SEBI Reg. no.: INZ000184638 NSE-TM ID: 12788 BSE-TM ID: 6395 MSEI-TM ID: 21000 MCX-TM ID: 29905 NCDEX-TM ID: 00732 SEBI DP R no. IN-DP-261-2016 DP ID: 12070600 RP ID: 12070600 |

A-17, Upper Ground Floor, Block-A, Pushpanjali Enclave Pitampura, New Delhi, Delhi 110034 |

-- | +91-11-47107777 | info@msbetrade.com |

| Sr. No. | Name of Individual | Designation | Phone Number | Email Id |

|---|---|---|---|---|

| 1 | MUNISH BAJAJ | Director | 011-47107729 | md@msbetrade.com |

| 2 | SUSHMA BAJAJ | Director | 011-47107729 | info@msbetrade.com |

| 3 | Surinder Kumar | Compliance Officer | 011-47107730 | surin@msbetrade.com |

| List of Authorised Persons (AP) | |||||||||||||

| Sr. No. | Authorised Person’s Name | Authorised Person Code (Exchange wise) | Constitution | Status | Address | Terminal Details (Exchange Wise) | |||||||

| (Approved / Cancelled | Add | City | State | Pin Code | Terminal Allotted (Y/N) | No. of Terminals | |||||||

| 1 | Ekram Hossain | NSE- AP2046000061 BSE- AP01639501159593 | Individual | Cancelled | 64/H/4, Broad Street, Ballygunge, | Kolkata | West Bengal | 700019 | N | Nil | |||

| 2 | Vijay Prakash Bhadani | NSE: AP2046000071 BSE: AP01639501162001 MCX: MCX/AP/166769 | Individual | Cancelled | Vijay Prakash Bhadani S/O Sh. Vishnu Prakash Bhadani Juna Math Bikaner, Rajjev Gandhi Marg, | Bikaner | Rajasthan | 334001 | N | Nil | |||

| 3 | Anjali Rawat | NSE- AP2046000021 BSE- AP01639501104745 | Individual | Cancelled | C-321, Nyay Khand 2nd, Indirapuram, Amarpali Village, Shipra Sun City | GHAZIABAD | UP | 201014 | N | Nil | |||

| 4 | Arun Kumar N | BSE - AP0163950151622 | Individual | Cancelled | 4l/15/B1, Unit-18, Golkholi, Kharagpur (M), Nimpura, | Nimpura | West Bengal | 721304 | N | Nil | |||

| 5 | Deepak Rehaja | NSE-AP2046000051 BSE- AP0163501153615 | Individual | Cancelled | House no. 412, Jaand Wali Gali, Near Rajdhani Institute, Bhiwani-127021 | Bhiwani | Haryana | 127021 | N | Nil | |||

| 6 | Mohammed Tahreem Ahmed | BSE- AP0163950147599 | Individual | Cancelled | 12, Kustia Masjid Bari Lane, Municipal Corporation, Tiljala, | Kolkata | West Bengal | 700039 | N | Nil | |||

| 7 | Sandeep Kumar | NSE- AP2046000031 BSE- AP01639501109528 | Individual | Cancelled | H. No. 394/A, Ground Floor, Nangal Thakran, Near Girls Primary School | Delhi | Delhi | 110039 | N | Nil | |||

| List of Authorised Persons (AP) cancelled by Members on Account of Disciplinary Reasons | ||||

| Sr. no. | Authorised Person/s Name | Status | Authorised Person Cancellation Details | |

|---|---|---|---|---|

| Date | Reason | |||

| - | - | - | - | - |

Disclaimer: Investment in securities market are subject to market risks, please read all the related documents carefully before investing

ATTENTION INVESTORS:

Update your Mobile Number and E-mail IDs with your Stock Broker: “Prevent unauthorized transaction in your Trading/Demat account. Update your Mobile Numbers/Email Ids with your Stock Brokers/Depository Participant. Receive information/alerts of your transaction (Trading A/c) directly from Exchange at the end of the day & Demat Transaction for all debit and other important in your demat A/c directly from CDSL on the same day on your Registered mobile/email.

About CAS facility: For the benefit of the investors SEBI directed Depositories to send the Consolidated Account Statement (CAS) for the investment of an investor in Mutual Funds (MF) and Securities held in Demat form with Depositories. In case the client do not desire to receive CAS then they can opt out of the facility by submitting a request letter to the DP duly signed by all the holders stating that they do not wish to receive CAS as per guidelines prescribed by SEBI in communiqué no. 4816 and 4900

KYC is one time exercise: "KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.),you need not undergo the same process again when you approach another intermediary."

Old DIS Booklet Phased out: DIS issued prior to 07-Jan- 2014 Phased out w.e.f. 06-Jan-2016 for Demat Transactions, Kindly contact your DP to receive New DIS to further transaction.

ASBA mandatory after January 1, 2016: "No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account."

Pledge/Block Mechanism: Stock Brokers can accept securities as margin from clients only by way of pledge/block mechanism in the depository system w.e.f. September 01, 2020.

OTP directly from Depository: Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

FAQ: Investors may please refer to the Exchange's Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

Margin: Pay 20% (or as per exchange) upfront margin of the transaction value to trade in cash market segment.

CAS: Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

ITORS: “The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc., of any of the Rules, Regulations, Bye-laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us.”

Beware of fixed / guaranteed / regular returns / capital protection schemes. Stock Brokers (Brokers/Members) or their authorized persons or any of their associates are not authorized to offer fixed / guaranteed / regular returns / capital protection on your investment or authorized to enter into any loan agreement with you to pay interest on the funds offered by you. Please note that in case of default of a member claim for funds or securities / commodities given to the Broker under any arrangement / agreement of indicative return will not be accepted by the relevant Committee of the Exchange as per the approved norms.

Do not keep funds idle with the Stock Broker. Please note that your Stock Broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. Please note that in case of default of a Member, claim for funds and securities/commodities, without any transaction on the Exchange will not be accepted by the relevant Committee of the Exchange as per the approved norms.

Check the frequency of accounts settlement opted for. If you have opted for running account, please ensure that your Stock Broker settles your account and, in any case, not later than once in 90 days (or 30 days if you have opted for 30 days settlement). In case of declaration of Member as defaulter, the claims of clients against such Defaulter Member would be subject to norms for eligibility of claims for compensation from Member funds / IPF to the clients of the Defaulter Member.

These norms are available on Exchange website at following link: https://www.mcxindia.com/Investor- Services/defaulters/sop-process-faqs-for-handling-of-claims-of-investors-of-defaulter-member

Stock Brokers are not permitted to accept transfer of securities as margin. Securities offered as margin / collateral MUST remain in the account of the client and can be pledged to the broker only by way of ‘margin pledge’, created in the Depository system. Clients are not permitted to place any securities with the Broker or associate of the Broker or authorized person of the Broker for any reason. Broker can take securities belonging to clients only for settlement of securities sold by the client.

Always keep your contact details, viz. mobile number / email ID updated with the Broker. Email and mobile number is mandatory and you must provide the same to your Broker for updation in Exchange records. You must immediately take up the matter with Broker / Exchange if you are not receiving the messages from Exchange / Depositories regularly.

Don't ignore any emails / SMSs received from the Exchange for trades done by you. Verify the same with the contract notes / statement of accounts received from your Stock Broker and report discrepancy, if any, to your Broker in writing immediately and if the Broker does not respond, please take this up with the Exchange/Depositories forthwith.

Check messages sent by Exchanges on a weekly basis regarding funds and securities balances reported by the Stock Broker, compare it with the weekly statement of account sent by Stock Broker and immediately raise a concern to the Exchange if you notice any discrepancy.

Please do not transfer funds, for the purposes of trading to anyone, including an authorized person or an associate of the Stock Broker, other than a SEBI registered Stock Broker.

Do not deal with unregistered intermediaries (who are not registered with SEBI/Exchanges).

.......... Issued in the interest of Investors

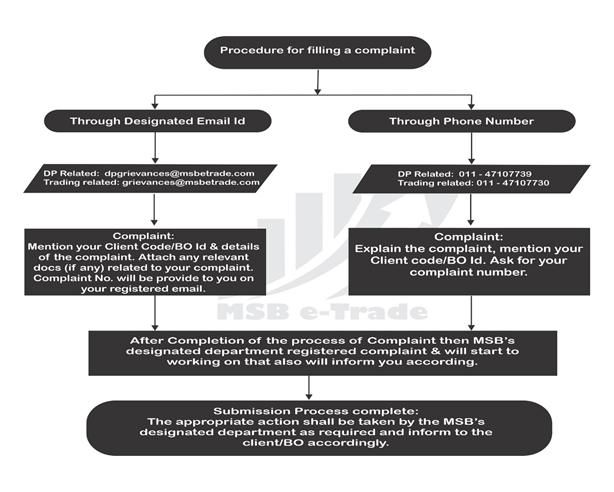

Investor Grievance:

In case of any grievances please write to: grievances@msbetrade.com (for Trading) dpgrievances@msbetrade.com (For DP)

Information regarding SEBI Complaint Redress System (SCORES)

Filing of complaints on SCORES – Easy & Quick

2026 MSB e-trade Securities Limited. All Rights Reserved.